Aviva is a multinational insurance company that provides a wide range of insurance, savings, and investment products. They offer services like life insurance, health insurance, car insurance, home insurance, and pension plans. Aviva helps individuals, families, and businesses protect their assets, manage risks, and plan for the future, making financial security and well-being more accessible.

Role:

Lead UX Designer

Industry:

Fintech / Insurance

Duration:

6 months

Challenges

Quoting for Life insurance should be easier than any other product very little information to generate a quote.

However, quote completion rates for life insurance lagged behind more complicated products, such as Home and Motor.

40% of customers dropped out of the journey before getting a quote.

The business already had a hypothesis going into this project:

If we reduce the number of questions and their complexity, update the design with the latest framework components, then we will achieve a higher quote completion rate.

The goals:

Simplify quote completion

Increase quote completion rate

Improve description of quote summary

Clarify cover options, amounts, and types

My Approach

Discovery Phase

I led UX on this project and worked with the following teams throughout the process UX Researcher, Visual Designer, Customer Experience, Data Science, Propositions, Legal, Compliance, and Risk.

Starting out I engaged with our UX research team, data team, and went through previous work on Life insurance and it's customers. Recent testing sessions had revealed major customer pain points with our existing journeys but also their needs for quoting for life insurance.

Pain points

Not wanting to give personal details first.

Confusion over cover types (increasing and decreasing).

Too much copy.

No apparent ability to edit quotes.

Design and Iteration

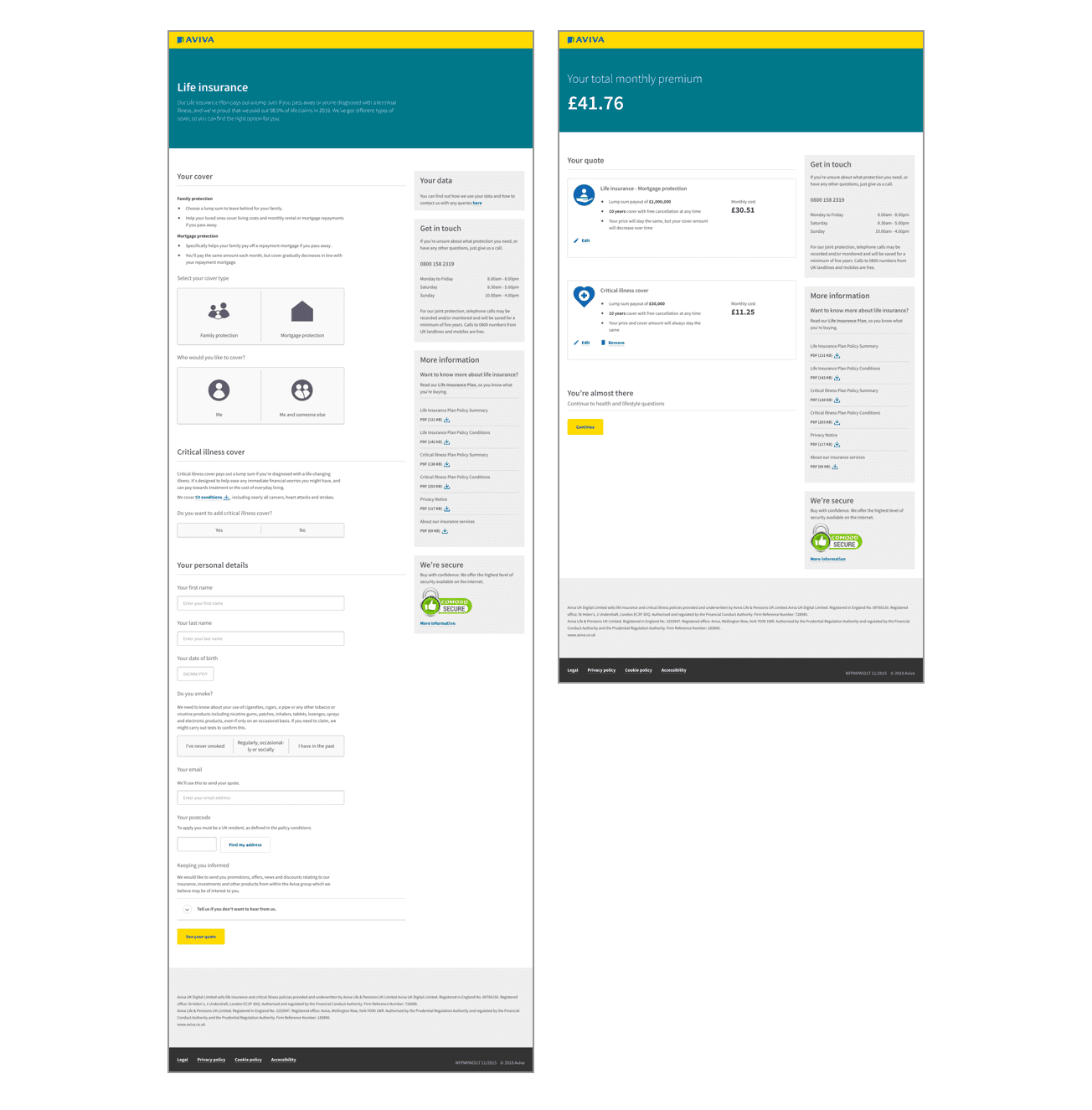

Stripping back the form to only essential fields to get a quote.

Challenging the business on what else needed to be on the form.

Testing the simplified form

Testers felt the process was too fast and didn’t reflect accurate quotes. They wanted more copy and understanding around each field.

Testers also had major issues with the definitions and logic behind the cover types.

The types of insurance Aviva was offering we're inline with what competitors were offering and didn't make sense to testers. Using the testing feedback we were able to work with our propositions team to introduce a different offering that made more sense and rewrite without jargon how it worked.

Results

The life insurance quote journey was released live in early Dec 2019 along side the existing journey being shown to 50% of customers. The new journey outperformed the exisiting journey and the decision was made to go 100% live.

Over the next quarter the updated life insurance journey reported:

+9 point quote completion rate

26% more sales for the quarter

Future Plans

Learning from analytics how customers naigate through the form, edit their quotes, and ultimately purchase to further improve and increase quote completion.

Working on the next step in the journey.

Conclusion

The design developed went against the initial business hypothesis but through constant research, iteration, testing we were able to output a design that worked well for customers.

Critical life insurance was added as an option as customers would normally purchase this in conjuntion with life insurance.

The sucess of this project led to working on next part of the journey ensuring customers got a consistent design from their quote to payment and confirmation.